The Critical Minerals Fund

Introduction

INTROPangaea Securities Limited and CHB Investment Holding GmbH have initiated the Critical Minerals Fund which is strategically focused on investing in African entities at advanced stages of mining exploration or those approaching production.

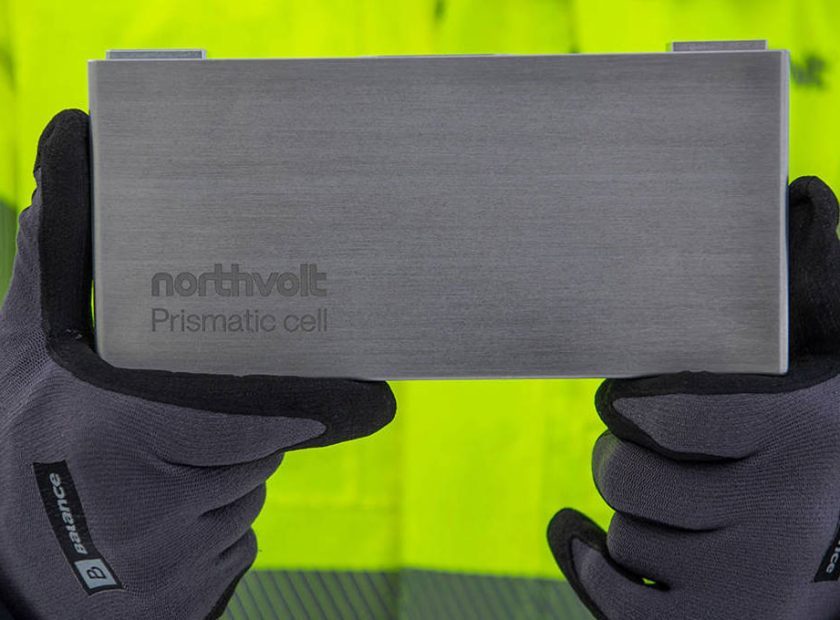

Central to the investment thesis is the prioritization of critical minerals pivotal to the advancements of the fourth industrial revolution. Specifically, the minerals of interest include copper, cobalt, lithium, gold, and manganese and the platinum metal group.

Investment Thesis Overview

INVESTMENTThe fourth industrial revolution brings a surging demand for critical minerals, essential for technological advancements. While electric vehicle (EV) components are central to this demand, there is a broader spectrum of needs, ranging from renewable energy, communication, internet of things, construction, space exploration, to infrastructure. Notably, a significant portion of these essential metals resides in Africa, especially within Southern Africa.

Challenges persist. These encompass constraints in exploration resources and expertise, challenges in capitalization and operational proficiency, and concessions often sold to foreign entities primarily focused on extraction without emphasizing value addition.

The Critical Minerals Fund is positioned to address some of these challenges, targeting Africans holding concessions aiming for operational status. Our investment strategy centers on acquiring stakes in African entities either at advanced mining exploration phases or nearing production. The Fund is committed to assisting these companies in achieving production, considering either an exit strategy post-production commencement or engaging in off-take agreements coupled with potential listings. Our joint venture general partner (GP) capitalizes on its vast experience in mining investment and management, aiming to navigate these challenges and actualize value.

At its core, the Fund’s mission is to propel economic development within Africa, tapping into the region’s mineral wealth, fostering employment opportunities, and advocating for sustainable practices.

4th

Industrial

Revolution

Value

Addition

Value

Addition

4th

Industrial

Revolution

Management Overview of the Fund GP

The GP management team of the Fund is assembled from seasoned professionals with expertise spanning mining, finance, and investment management. Their collective experience is underscored by a history of effective investment strategies within the African mining sector, encompassing exploration, development, and production stages. The team’s primary responsibilities include the identification and assessment of potential investments, thorough due diligence execution, and the meticulous management of the Fund’s portfolio.

Overview of the Fund

The Fund is strategically poised to channel investments into entities specializing in critical minerals, notably copper, cobalt, lithium, gold, and manganese. Our investment paradigm emphasizes acquiring stakes in companies that are either deep into their exploration phases or on the cusp of production, with a dedicated objective of assisting these entities in achieving production milestones. By adopting this approach, the Fund seeks to address prevalent challenges in the region’s mining sector, including constraints in exploration resources, expertise, and the necessities of capitalization and operational management.

Fund Structure

The Critical Minerals Fund structured into 4 Pools of Capital to focus on Hydrogen Metals, Electrification Metals, Battery Metals, Strategic & Technology Metals. The structure allows Industry to participate in the Fund concurrently as GP and LP. GP by seeding the Pool of Capital and LP by committing capital to the Fund overall. The Fund to be waterfalled into the Pools of Capital based on the ILPA principles on Investment Restrictions.

Hydrogen

Metals

PGM‘s

Electrification

Metals

Copper & Co-Products

Battery

Metals

Lithium, Cobalt, Nickel, Manganese, Graphite

Strategic and Decarb. Metals

Iron Ore, Gold, Rare Earths

Africa-centered Sustainability and Ethical Practices

In recognizing Africa’s vast mineral resources and diverse ecosystems, the Fund remains committed to endorsing sustainable and ethical mining practices throughout the continent. Our investment orientation is discerningly focused on entities that commit to preserving the African environment, valuing its unique heritage, and fostering the wellbeing of its local communities. By adhering to these principles, the Fund not only seeks robust financial returns but also aspires to effectuate tangible positive impacts within the regions and communities of our African investments.

The Two Founders

FOUNDERSAdvisory Board

BOARDManagement Team

MANAGEMENTPARTNER